Pennsylvania is Now Accepting online applications for the Homeowner Assistance Fund program. PHAF is administered by the Pennsylvania Housing Finance Agency (PHFA) and supports homeowners in the Commonwealth who were experiencing financial hardship as a result of the COVID-19 pandemic beginning January 21, 2020.

If you want to apply for the Pennsylvania Homeowner Assistance Fund, you must meet the eligibility requirements and provide the required information.

What is the Pennsylvania Homeowner Assistance Fund?

The Pennsylvania Homeowner Assistance Fund is a housing-related program, also known as PAHAF. The program is funded by the U.S. Treasury to help Pennsylvania homeowners encountering financial hardship as a result of the COVID-19 pandemic.

The goal of the program is to provide financial assistance for eligible mortgage and housing-related expenses to homeowners seeking to address delinquency and avoid default, foreclosure, or eviction.

This program assists homeowners prevent mortgage delinquency, default, foreclosure, eviction, and utility disconnection. under the PAHAF, the assistance fund for any homeowner is $50,000 or up to 24 months of assistance, and the utility assistance limit is $10,000.

Eligibility Requirements for Pennsylvania Homeowner Assistance Fund

The Homeowner Assistance Fund program will accept applications from eligible Pennsylvania homeowners who meet the following criteria:

- The homeowner owns and occupies the property as his or her primary residence in Pennsylvania.

- The homeowner’s property must be in Pennsylvania.

- The homeowner must have experienced financial hardship in the COVID-19 pandemic since January 21, 2020, and is seeking assistance with past-due mortgage and housing-related expenses.

- Homeowners must pay mortgage payments and/or housing-related expenses at least 30 days in advance of the date for which they are requesting PAHAF assistance, except for Forward Mortgage Assistance, for which, as a standalone option, Mortgage payments cannot be delayed to receive the funds.

- Their household income must be less than or equal to 150% of the area median income (AMI). Click here to determine your income eligibility for PAHF.

- The homeowner’s first mortgage, at the time of origination, must not exceed the Fannie Mae/Freddie Mac conforming loan limit in effect at the time of loan origination.

- The homeowner must not have already received assistance or applied for assistance with mortgage payments, mortgage reinstatement, property fees, and/or utility payments from any other federal, state, local, non-profit, or tribal source.

Required documents:

To apply for Pennsylvania Homeowner Assistance Fund application, every homeowner applicant must provide the required documents. such as:

- Copy of government-issued photo ID

- Copy of your Social Security or Tax Identification card, showing the required last four digits, or submit income tax-related forms such as 1040s, W2s, and 1099s.

- Proof of current income (such as the previous year’s Tax Return, a month’s current pay stubs, etc.)

- Proof of home ownership (e.g., copy of a recently recorded deed, tax bill)

- Confirm material related to a decrease in income or an increase in expenses.

How to Apply?

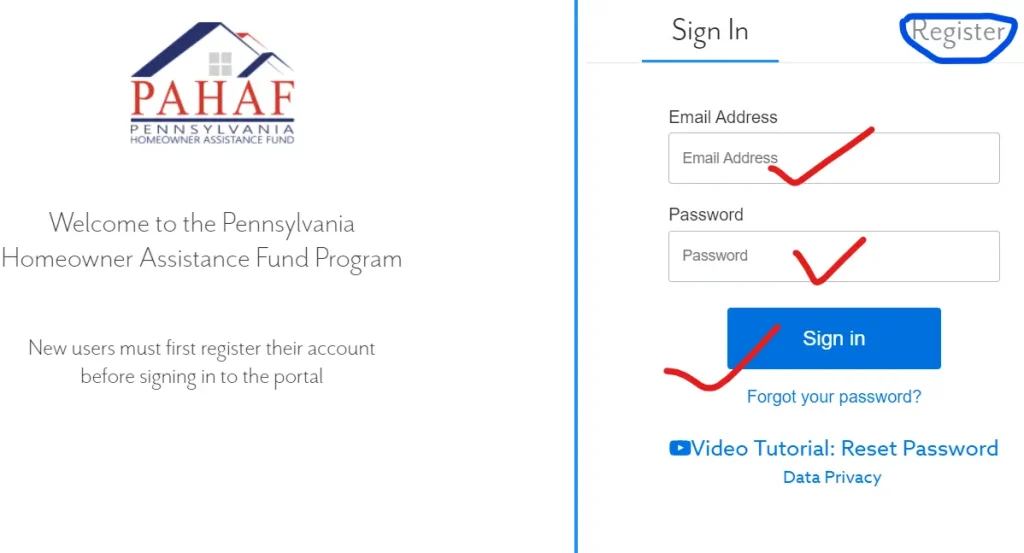

To apply for Pennsylvania Homeowner Assistance Fund (PAHAF) Application, you must qualify for the PAHAF program and gather the required documents. now, you can follow the steps below.

- Simply, visit the official PAHAF.

- If you are a new user, you must register your account first.

- Once the account is created, please login to your account using your username and password.

- Fill out the application form with the required information.

- Upload the Required documents.

- Click on the submit button.

To get any assistance, you can contact us through phone number at 888.987.2423. Also, you can track your PAHAF application status by phone number and Login your account.

Leave a Reply